How Food Companies Can Use Social Data For Product Development

By Ingrid Ewen, Online PR Officer, Talkwalker

Most people love food. Just the mere thought of lunch or dinner can make our stomachs rumble, so it’s no surprise that food is one of the most discussed topics on social media.

The products provided by FMCG manufacturers, especially food items from candy to canned goods, are staples of everyday life for people across the world. That makes it all the more important for companies, especially for global players, to understand their customers and to be able to adapt their products according to local tastes and preferences.

Social listening can help marketing departments of food manufacturers to analyze the social media performance and online reputation of the different brands in their portfolio. By digging deeper into social conversations they can also better understand global and regional consumption patterns and customer attitudes toward niche products, such as organic or gluten-free items, to find new markets, or to refine their product offering according to market needs.

In this how-to guide, we will also explore how social media monitoring can help larger companies to:

- Enhance product development processes

- Refine product launches through effective measurement

- Optimize the performance of brand portfolios

- Measure the ROI of social activity

We will use examples of well-known brands owned by globally active corporations such as Nestle, Unilever, Mondelez International, and others to showcase how social media analytics can help food brands to succeed in a market where the consumer habits are subject to constant change.

Developing A New Product — Understand Global & Regional Tastes

For food manufacturers, understanding new trends in nutrition and developing products that match consumers’ tastes is essential to ensure the success of their products. Social listening can help them discover those trends and analyze customer preferences across countries or regions to help with their product development.

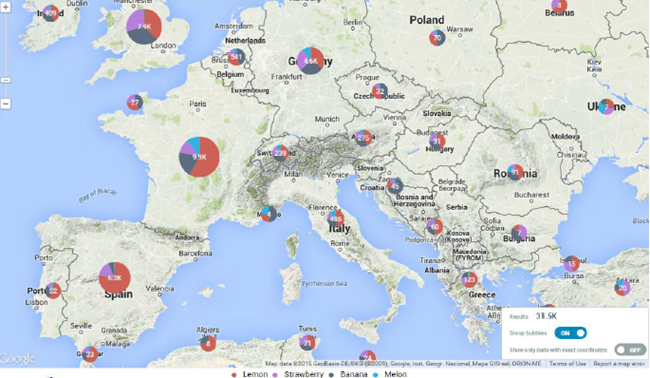

For example, understanding the fruit flavors that are popular in each region can help when trying to create a new product for a certain market. In the map below, discussions concerning flavors such as lemon, strawberry, banana, and melon have been analyzed across Europe.

While lemon wins out in most of Europe over the past 30 days, melon was a popular ingredient in France — but mostly ignored across Britain.

We can see that while lemon is very popular across the South and Central Europe, particularly Spain and France, in countries like Germany and the U.K., banana has a roughly equal level of popularity. It’s also noticeable that in Britain and Spain melon is not popular at all.

Knowing which fruits and flavors are the most discussed in certain regions helps food manufacturers get an understanding of the popular flavors in each market. This kind of instant insight can shorten the research & development process of new products. Tying this information together with traditional market research, manufacturers can also reduce the risk involved in bringing new products to market.

Leverage New Trends In Nutrition

With new trends in nutrition and diet cropping up all the time around the world, staying on top of the latest developments is key for food manufacturers. One such trend is the Paleo diet, which is a diet based on the types of foods presumed to have been eaten by early humans, consisting chiefly of meat, fish, vegetables, and fruit. It excludes dairy or cereal products and processed food.

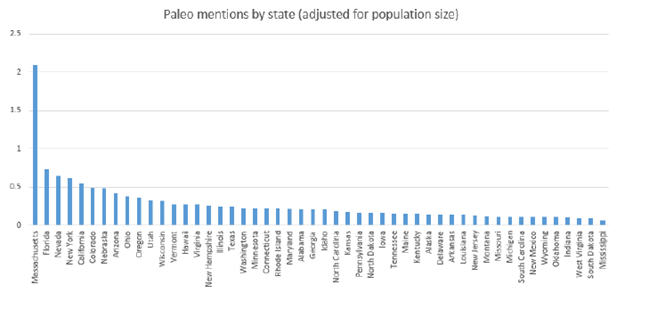

Below is an example of mentions of the Paleo diet in the U.S. by state adjusted to account for difference in population size:

Massachusetts and Florida were the top states talking about Paleo from mid-June to mid-August

Here, we can clearly see that Massachusetts registers the most discussion of the Paleo diet, followed by Florida, Nevada, New York, and California. South Dakota and Mississippi talk about the diet the least. The comparison shows that interest in the diet is more than three times higher in Massachusetts than in Mississippi.

For food brands, this knowledge can be invaluable in helping them promote their products according to local preferences. In this case, Californians seem relatively interested in diet trends such as Paleo, while people in West Virginia seem to care much less about such developments. In order to increase interest in regions such as West Virginia and Mississippi, manufacturers could consider raising awareness and interest in areas that show little interest — a potentially big investment — or just focus on areas where people are already discussing nutritional trends.

Food manufacturers can also listen in to social conversations about nutritional trends to get a better understanding of the ingredients, lifestyles, and products that are linked to a particular trend.

Sticking with the Paleo example, this diet requires high levels of protein while avoiding grains — the latter being a perfect fit for people suffering from a gluten sensitivity. We can also see that hashtags such as #lowcarb and #smoothie are appearing in social discussion. Such insights can give food brand an idea of how to market a new product and which customer segments to target.

If a product portfolio already contains products that match the requirements of a specific diet, as is the case with the Paleo diet and a gluten-free diet, manufacturers can use the opportunity to adapt their marketing strategies and highlight how the product fits the needs of people following a strict diet.

Refining Product Performance — Successfully Launching Products

With constant changes in the way people eat due to new diets and trends, food manufacturers are under pressure to release new products to adapt to those changes. At the same time, new products being launched regularly have made consumers used to variety, meaning they are looking for more exotic flavors or health benefits in their food whenever they try something new.

Developing and launching new products under these circumstances can be a challenge. Through careful social listening, brands can find crucial insights that indicate how the public feels about certain products. Mondelez International’s cookie brand Oreo released a number of varieties for the summer, among them new flavors ,as well as a thinner variety of their established cookie.

Oreo Thins dominated the conversation about new products for the brand in July

The focus of the attention was clearly on the thinner variety, with more than 5,400 mentions for the #OreoThins hashtag over a 30-day period. In comparison, the new flavors received just a handful of mentions in total — a great example of how simultaneous campaigns for a brand can cannibalize instead of support each other. A better approach here may have been to stagger the launch of each flavor or tie the flavor’s launch closer to the Oreo Thins campaign to increase attention for both.

For companies bringing a new product into the market, keeping track of online mentions around the product is key to a successful launch. Within test markets, food brands can monitor customer reactions toward new products to see which new things customers like and which aspects manufacturers need to work on to ensure successful product performance in a larger market.

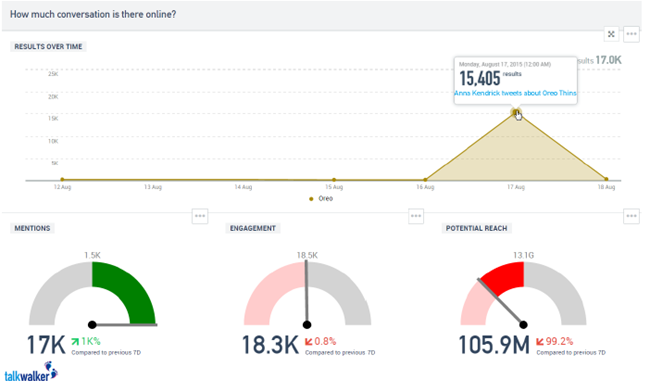

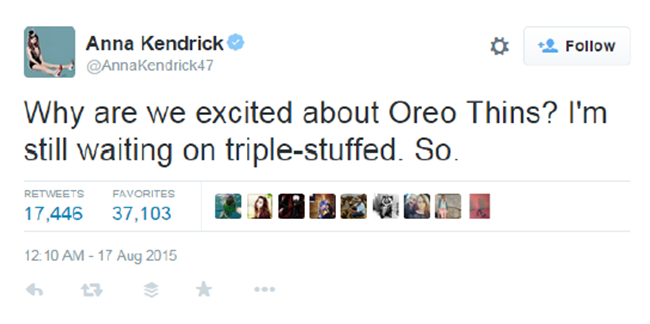

Mentions of Oreo Thins spiked after a tweet from Anna Kendrick

By keeping tabs on social mentions post launch, marketing teams can see if their product is managing to generate steady interest, or capitalize on a mention from a high-profile celebrity. In this case, Oreo Thins received a mention from U.S. actress Anna Kendrick that caused a big spike in activity.

Although the mention is not 100 percent positive, it has clearly generated interest in the product and by acting quickly, this kind of attention could easily be turned into a positive. And, depending on the amount of interest shown by users — this could even be a catalyst for a new product or a special offer.

Choosing the right tone and strategy in your communication is essential. By monitoring the conversation about a new product, companies are able to gauge public reaction and if necessary, adapt their communications (and even their products) in real-time to ensure success.

Adapting Products To Customer Taste

New trends in nutrition result not only in new products, but quite often they also involve changes and updates in the recipes and formulas of existing products. One such update that many food manufacturers are currently looking into is replacing the dye used in their products with more natural ingredients after consumer groups voiced concerns about certain ingredients.

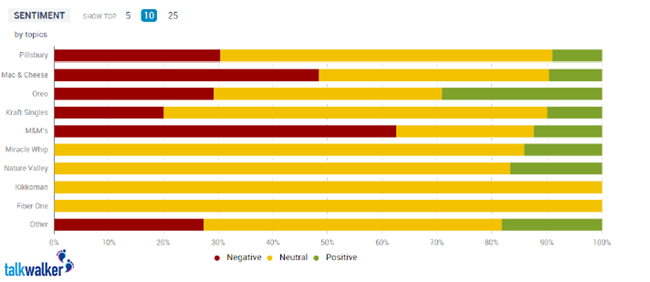

Negative sentiment in conversation about food dye soared for M&M’s and Kraft’s Macaroni & Cheese in July, while other companies were praised for not using artificial colors

In the graph above, negative sentiment soars for Kraft’s Macaroni & Cheese product in the conversation about food dye. Much conversation here centers on the comparison of types of dye used for the products sold in the U.S. and the more natural ingredients used in the European market. The company has promised to remove the artificial dyes from its products in the U.S.

M&M’s, produced by Mars, faced a similar dilemma after consumers launched a petition to remove artificial dye from the candy as the company had done in Europe. For both companies, keeping track of customer reaction to the change is an uneasy way to see if the new formula will be accepted by their customers or if it needs further adaptation.

With major food manufacturers sourcing ingredients of all kinds from around the world, such crises are increasingly commonplace. Careful monitoring of fluctuations in sentiment ensures that brands can both be alerted to issues as they arise and see whether changes have had an effect on public perception.

Optimizing Product Portfolios — Finding The Most Successful Products In Your Portfolio

For every company it is important to know which of its brands are the most successful to find out which of them should be kept in their product portfolio and which ones should be replaced. A refined product portfolio will guarantee an increase of overall sales volumes and boost revenues. By analyzing which products are the most discussed online and evaluating the tone of these conversations, food manufacturers can evaluate the performance of their portfolio brands.

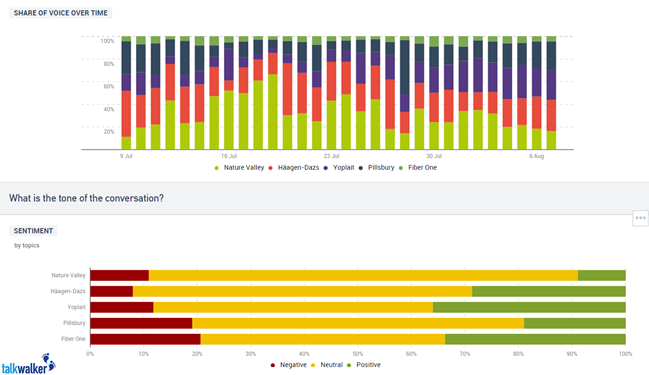

Nature Valley and Haagen-Dazs dominated the conversation for General Mills products in July, while Yoplait and Fiber One enjoyed the most positive mentions

For the U.S.-based General Mills corporation, most attention online went to its ice cream brand Haagen-Dazs and its Nature Valley granola bars in July. In terms of sentiment, Yoplait and Fiber One generated the most positivity in the company’s portfolio, with the yogurt brand reducing the sugar content in its product and Fiber One introducing a new flavor for their granola bars. By contrast, Pillsbury suffered for a quite a few unflattering comparisons with the iconic Doughboy.

The power of the brand is critical for food manufacturers as consumers can often stick with the same brand for a long time based on habit and reputation. Careful tracking of the different brands in a portfolio can help you to make sure your brand stays top of mind and makes adjustments when attention starts to slip. Monitoring performance over time also helps companies to understand when rebranding needs to take place or if a product line needs to be stopped completely.

Benchmarking Products against Competitors

Keeping track of competitors is just as important as being aware of the conversation about your own brands. Monitoring the online and social media presence of competitors allows for a quick overview of how new campaigns or products are perceived by the audience. If necessary, the communication or marketing strategy can then be adapted to better resonate with customers and prospects alike.

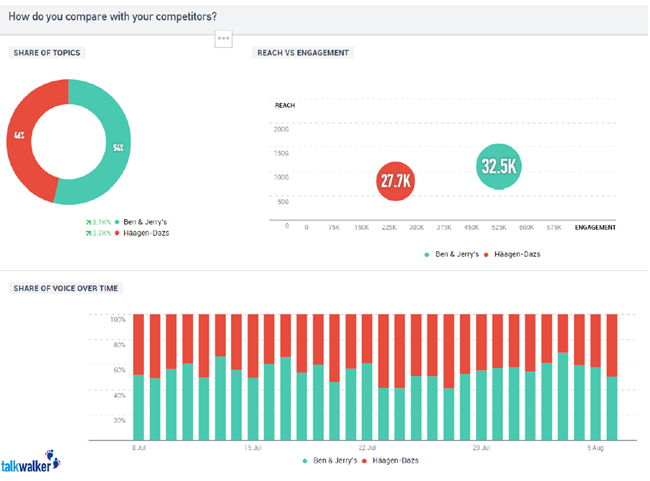

A direct comparison of different key metrics for a brand can be helpful in adapting communication and marketing strategies

By defining and comparing different KPIs, brands can benchmark their performance against their competitors. Monitoring their own performance as well as their competitors’ side-by-side is a great way to visualize this comparison.

The graph above shows the share of voice and potential reach as well as engagement for ice creams brands Haagen-Dazs and Ben & Jerry’s. While Ben & Jerry’s takes the lead overall, Haagen-Dazs managed to win most mentions for a few days in late July through its partnership with car service Uber for #UberIceCream campaign.

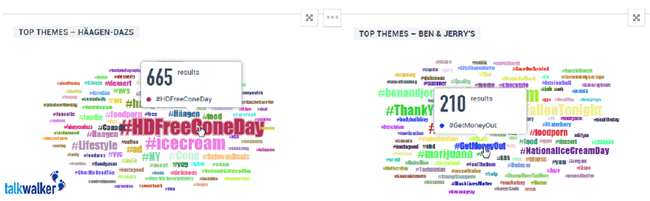

Theme clouds for both ice cream brands between mid-July and mid-August show more mentions of Haagen-Dazs marketing campaigns

A direct comparison of hashtags mentioned in context with both brands shows that Haagen-Dazs attracts a lot of attention through its marketing campaigns like the ice cream delivery with Uber drivers or the #HDFreeConeDay campaign.

In contrast, Ben & Jerry’s saw a lot of mentions related to politics and political activism like fighting corruption in politics, largely due to the involvement of the company’s co-founder, meaning the conversation is much less focused on the brands’ products than it is for Haagen-Dazs.

By getting a clear idea of competitors’ performance, brand managers can set relevant targets and social KPIs to effectively measure their efforts. And by digging deeper into results, brands can make more accurate assessments of marketing performance vis a vis the competition.

Measuring Product Success

The buzz word around a new product or campaign can be helpful in measuring its success. Analyzing the ROI, however, is just as important. Correlating the buzz around a particular product with sales numbers over the same period is one way to calculate the ROI of a campaign.

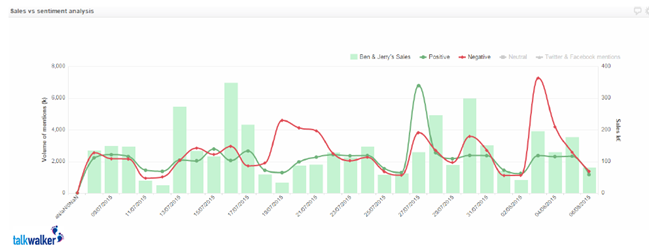

Correlating positive and negative mentions with sales data can help measure campaign ROI

By combining the data from different sources — overall buzz from online and social media and sales figures — brands can estimate which of their product campaigns and communication strategies are the most effective. The graph above is an example of an integrated chart using hypothetical Ben & Jerry’s ice cream sales figures and comparing them with the growth of positive and negative mentions during a selected period.

This kind of integrated data visualization helps marketers put clear ROI figures of their product performance, improving their reporting capabilities, and giving them a better understanding of the extent to which their social success translates to actual sales. From a management’s perspective, these graphs bring clarity to the actual bottom line impact of marketing efforts and provide a good metric for assessment of team performance.

Conclusion

Trends and tastes in food and nutrition are changing all the time as new research comes to light and new products alter our preferences. These constant changes make it hard for the companies that produce our food to keep up and always deliver what customers are looking for.

But with social listening, these companies can get a better understanding of these trends and then use these insights to satisfy the millions of consumers around the world who buy their products every day. They can master this challenge and ensure their products succeed in the market by using social listening to:

- Improve product development by understanding trends and regional preferences

- Refine product launches through accurate measurement of marketing campaigns

- Optimize portfolio performance through careful brand listening

- Measure campaign ROI by integrating social data with sales figures

Food will always be a hot topic of discussion on social and other online channels. This vast quantity of social data holds plenty of information that food manufacturers can use to their advantage. By using effective social listening, they can find the golden nuggets of insight that can help improve the bottom line.

About The Author

Ingrid Ewen works as the Online PR Officer for Talkwalker, a social intelligence provider based in Luxembourg. She holds a Bachelor's degree in English Language, Literature, and Linguistics from the University of Trier.

About Talkwalker

Talkwalker is one of the world’s leading social data intelligence companies. Its 1500 servers process 500 million posts from 150 million websites every day. Talkwalker’s state of the art social data intelligence performs platform monitors and analyzes online conversations on social networks, new websites, blogs, forums, and more in over 187 languages.

Talkwalker social data intelligence platform is used by over 500 clients around the world, including Volkswagen, Benetton, KPMG, Merck, BASF, Ogilvy, Publicis, Peppercomm, and Weber Shandwick.

Get In Touch

Talkwalker Americas: +1 646 712 9441

Talkwalker EMEA: +352 20 33 35 3 43

contact@talkwalker.com

@Talkwalker